On July 16th, 2018, the International Monetary Fund (IMF) released the latest 2018 World Economic Outlook (WEO) report, giving analysis and forecast of global macro economy in 2018 and 2019. According to statistics, global economy will sustain cyclical recovery as a whole. However, global trade growth will fall due to factors such as increased trade friction. Since factoring is a supply chain finance business based on real trade, the decline in global trade growth will have an adverse effect on factoring industry.

I. Global economy will sustain cyclical recovery as a whole

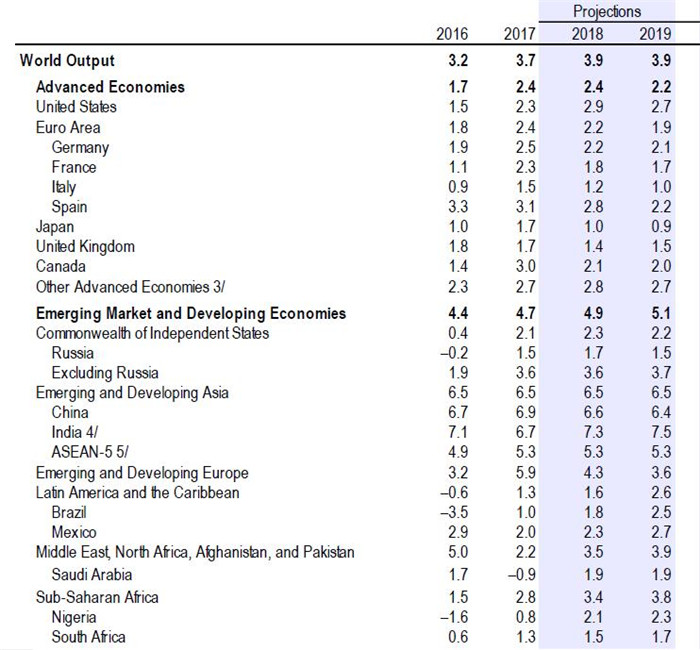

The IMF is optimistic about global economic growth. The WEO report shows that global growth is projected to reach 3.9 percent in 2018 and 2019. Advanced economy growth rate is expected to be 2.4 percent and 2.2 percent, while emerging markets and developing economies are expected to reach 4.9 percent and 5.1 percent. Emerging and Developing Asia economies are expected to maintain robust performance, growing at 6.5 percent in 2018 and 2019. In China, the authorities are taking important measures to limit credit growth and to strengthen supervision of local governments and the financial industry. Though welcomed by the market, these measures could trigger repricing of financial assets and increase rollover risks, bringing greater negative impacts than market expectations. In 2018 and 2019, China is expected to remain an economic growth rate of 6.6 percent and 6.4 percent respectively.

Meanwhile, the WEO report points out that growth prospects of global economies are becoming more uneven and the risk of economic downturn is on the increase. Among developed economies, the United States sustain strong development in the short term, but forecasts of economic growth rate for the euro zone, Japan, and the United Kingdom are lowered. Affected by risen oil prices and higher production, oil-producing countries such as South Africa, Afghanistan, and Pakistan gather momentum; while dollar appreciation, upgraded trade tension, and foreign exchange pressure has challenged emerging economies such as Argentina, Brazil, and India.

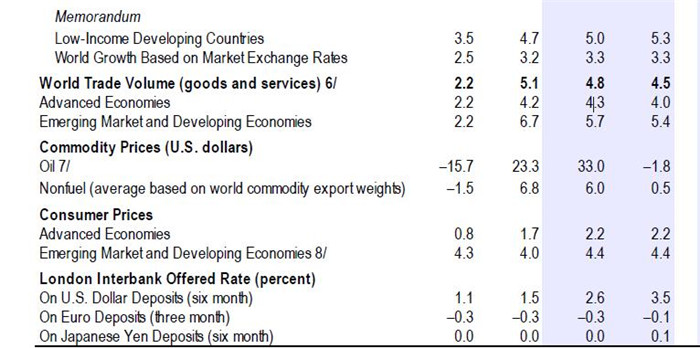

Table 1. Overview of the World Economic Outlook Projections (2016-2019)

Notes: Percent change, unless noted otherwise

Source of data: IMF

II. Global trade growth will fall

At present, complicated and variable international trade environment increases uncertainty. Amid some developed countries, support for global economic integration is weakening. During the last few months, the United States imposed high tariffs on various types of imported goods, causing trade partners to take retaliatory measures. In addition, trade partners turned to seek diversified trade relationship, such as the North American Free Trade Agreement and the Trans-Pacific Partnership Agreement. In addition, trade negotiations between EU and Australia, China and Japan, South Korea and Russia have been recently launched.

Among emerging economies, tightening world trade relationship and geopolitical issues could trigger potential conflicts. Factors such as unemployment rate of the United States falling below 4% and prospect of interest-rate growth may lead to exchange rates fluctuation and adjusted investment portfolio of international investors, which in turn impairs capital inflows into emerging markets. Affected by escalated trade tension, Business and financial markets could undermine investment and trade. The WEO report shows that the growth rate of global trade volume (including goods and services) for 2018 and 2019 is expected to fall from 5.1% in 2017 to 4.8% and 4.5% gradually.

III. To have an adverse effect on factoring industry

Since 2000, global factoring industry has caught public attention and kept a compound annual growth rate of nearly 8%. Factoring has become the fastest growing supply chain finance industry worldwide, playing significant role in promoting domestic and international credit trade, providing financing solutions for SMEs and supporting real economy. However, with economic globalization suffering setbacks and trade friction escalated in recent years, the authorities continue to deepen economic supply-side structural reforms, tighten supervision of the financial sector and strengthen de-leveraging measures in China. What will happen to factoring industry in the context of global economic growth and trade friction?

It is recognized by scholars worldwide that factoring industry is countercyclical. For example, after the outbreak of international financial crisis (from 2009 to 2014), global factoring industry almost doubled in size and the grow rate of the factoring industry reached four times of GDP growth rate in the same period. When traditional financial service cuts down on credit (to SMEs in particular) during economic downturn and risk escalation, factoring industry can make up for the shortage of supply and achieve contrarian growth. The countercyclical feature of factoring is not equal to reverse relation (negative correlation) between the factoring business and economic growth.

In sharp contrast with excessive sensitivity of bank credit business, during economic downturn, factoring is not so easily affected by financing risks as bank credit services. Prerequisites such as real trade background and effective risk-transferring mechanism and risk control measures make it relatively low risk for factoring when financing. Therefore, factoring produces a substitution effect for traditional financial services.

In fact, factoring and economy are positively correlated. John Brehcist, Advocacy Director of the International Factoring Federation (FCI) finds in a recent study that the development of global factoring and economic growth are not only positively correlated, but they also bear a high beta coefficient. When economic growth rate rises, factoring and accounts receivable financing business could have good performance; when economic growth rate declines, the development of factoring and accounts receivable financing business is inhibited. When using the 28 EU countries as research objects, the correlation between GDP growth rate and FCF growth rate will be higher.

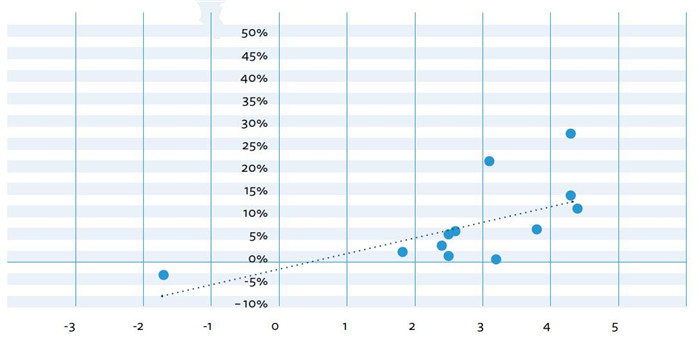

Chart 1 Global GDP growth rate vs FCF growth rate

LetÆs use ōoptical fit curveö and analyze the relationship between the two variables further. In the chart below, the x-axis represents global GDP growth rate and the y-axis represents global FCF growth rate. According to the chart, the slope of optical fit curve is positive.

GDP growth rate vs FCF growth rate

The above charts show that the positive correlation between GDP growth rate and FCF growth rate is strong (if not, dots in the second picture will be randomly distributed instead of gathering in bundle). In fact, the correlation coefficient is about 0.6 (0.0 means not related, above 0.5 means strongly related, and 1.0 is a perfect linear relationship). The optical fit curve (dotted line in blue) indicates that for every 1 percent increase in GDP, the FCF increases by about 3.5 percent (and the vice versa, when economic growth rate declines, factoring growth rate decreases). On the other hand, factoring growth signifies that trade is developing and economy will grow. In this case, factoring can be an indicator for the entire economic performance.

Of course, the positive relationship may be overshadowed by other factors such as economic structure, law and regulation. At the national level, such influencing factors may work simultaneously in promoting or inhibiting the development of factoring industry; however, an annual analysis based on the intercontinental level and global level suggests that the positive relationship between factoring industry growth and economy growth is proved to be very strong.

Normally, global economy and international trade growth rate should be coordinated in variation, and the growth rate of international trade is a more sensitive indicator. During economic upturn, international trade growth rate tends to be higher than economic growth rate; during economic downturn, global trade growth rate tends to fall faster than economic growth rate. However, in the context of global trade friction escalated, though global economy will sustain cyclical recovery as a whole, global trade growth rate will fall this year and next year. From this, it can be analyzed that falling global trade growth rate will have a negative effect on the growth rate of international factoring business, while domestic factoring business is less affected.

Han Jiaping, Researcher and Head of Credit Research Institution of Chinese Academy of International Trade and Economic Cooperation,

Chief of CFEC (Commercial Factoring Expertise Committee of CATIS)Dr. Jiao Wanhui, Head of Research and Advocacy Department of CFEC (Commercial Factoring Expertise Committee of CATIS)